When people search for net worth, they usually want a clean number. With public-facing entrepreneurs, that number is rarely clean. Equity splits stay private. Tax treatment varies. What was sold versus retained often remains undisclosed.

Table of Contents

ToggleFor someone like Tom Bilyeu, the more accurate story comes from verified milestones and what those milestones imply.

The facts that can be sourced responsibly are solid. He co-founded Quest Nutrition. He helped scale it into a breakout consumer brand. The business was acquired in a deal publicly described as a $1.0 billion purchase price, with the acquirer also describing an approximately $870 million net purchase price after tax benefits.

From that foundation alone, serious estimates land in a multi-hundred-million conversation, even though no precise personal figure can be audited.

Today, we will focus on what can be documented, what that documentation suggests, and what it does not. Let’s get started.

Key Highlights

- Tom Bilyeu’s wealth is anchored to founder equity in Quest Nutrition, acquired for a $1.0 billion headline price, with no verifiable personal net worth figure disclosed.

- Responsible estimates place his net worth in the multi-hundred-million range, but any single number remains non-audited and speculative.

- Quest’s value came from bootstrapping early, scaling influencer-driven distribution, and preserving founder equity before a minority investment.

- Post-Quest income streams include media and IP via Impact Theory, alongside regulatory risk highlighted by the SEC NFT settlement.

Read more: Do you know which podcaster takes the first place in its net worth? Find out here!

Tom Bilyeu Net Worth In 2026 & What Can Be Stated Responsibly

A precise net worth figure for Tom Bilyeu cannot be verified from primary sources. He is not required to disclose personal holdings.

Sites that publish single numbers such as $400 million or $470 million rarely show auditable methodology, cap table evidence, or tax assumptions, and they often contradict each other.

What can be stated responsibly rests on documented anchors.

- He co-founded Quest Nutrition, a company acquired for $1.0 billion.

- The acquiring company described the deal as approximately $870 million net of tax benefits.

- Quest Nutrition was bootstrapped early, then later took a minority investment, reportedly valuing the company at about $900 million in 2015.

- U.S. Securities and Exchange Commission filings show Impact Theory sold NFTs in 2021 and raised roughly $30 million.

- The same SEC action resulted in a settlement requiring over $6 million in disgorgement, interest, and penalties, along with other remedies.

From those anchors, it is fair to say his wealth stems primarily from founder equity in Quest Nutrition, followed by media, IP, and investing activity.

Any single-number net worth claim for 2025 should be labeled as an estimate and treated as non-audited.

Before Quest Nutrition, The Setup Years

The Quest story did not start from zero. Multiple sources describe the founders coming off a prior software business, Awareness Technologies, before launching Quest Nutrition in 2010. That detail changes the frame.

By the time Tom Bilyeu entered consumer packaged goods, he already had experience building companies and handling operational pressure. The move into nutrition was not a first swing at entrepreneurship. It was a pivot informed by earlier wins and losses.

The early consumer insight that became the wedge was simple to describe and hard to execute at scale. Protein snacks that targeted macros and taste while minimizing sugar. Simple to say. Expensive and complex to deliver consistently.

How Quest Nutrition Reached A Billion-Dollar Headline

Quest Nutrition’s rise to a billion-dollar headline came from a rare mix of sharp product positioning, obsessive execution, and a marketing system that turned everyday customers into visible proof of the brand’s promise.

Timing And Product Positioning

In the early 2010s, fitness culture expanded rapidly, and social platforms began turning everyday creators into distribution channels. Quest Nutrition leaned into a message that traveled well in that environment: high protein, low sugar, convenient formats.

Media coverage later described the brand’s rise as the product meeting a cultural moment. That moment rewarded functional benefits people could talk about repeatedly.

Influencer Marketing Before It Was A Default Playbook

Quest’s early marketing playbook became widely cited because it was direct. The company seeded product to fitness creators who already had trust and visible results. A quote attributed to Tom Bilyeu captured the thinking, people with six packs are walking billboards.

- Free product at scale.

- Reposting user recipes.

- Encouraging hashtag culture.

- Turning customers into repeat content producers.

The system worked because it gave fans something to do, not just something to buy.

Documented Hypergrowth

Two high-authority business publications tied Quest Nutrition to extraordinary early growth.

A Forbes interview cited 57,000% growth in the first three years and referenced the company’s Inc ranking.

Inc. reported Quest hit the No. 2 spot on the Inc. 5000 in 2014 and cited the same scale of early revenue expansion.

Outcomes like that require more than clever branding. Distribution, supply chain execution, and constant iteration across product, packaging, and channel strategy do the heavy lifting.

@tombilyeu Here is the advice I would give my 18 year old self. 🔑🔑🔑#peptalk #hearmeout #realtalk #motivation ♬ original sound – Tom Bilyeu

Bootstrapping First, Strategic Capital Later

Reporting describes Quest Nutrition as bootstrapped in its early years, followed by a minority investment in 2015 that reportedly valued the company at around $900 million.

That sequence mattered.

- Bootstrapping preserved founder equity during the riskiest phase.

- A later minority round at a high valuation provided capital and validation without a full loss of control.

Founder economics are shaped long before a sale announcement. Early choices around capital structure often matter more than the exit headline.

The Acquisition, The Most Concrete Money Reference

The Simply Good Foods Company publicly described its acquisition of Quest Nutrition in language that gives a rare fixed reference point.

- Announced purchase price, $1.0 billion in cash.

- Net purchase price described as about $870 million after tax benefits.

- Cash-free and debt-free basis, subject to customary adjustments.

SEC filings outline the structure and entities involved.

What that does not say is how much any individual founder received. Proceeds depend on ownership percentage, vesting, prior liquidity, and tax treatment. The deal explains the scale of value created, not personal take-home numbers.

Where His Wealth Likely Comes From In Practice

Without access to private holdings, the most honest way to think about wealth is through income engines.

Founder Equity From Quest Nutrition

A meaningful founder stake in a company acquired for $1.0 billion explains why estimates cluster high. Even conservative assumptions place that outcome in life-changing territory.

Media And IP Through Impact Theory

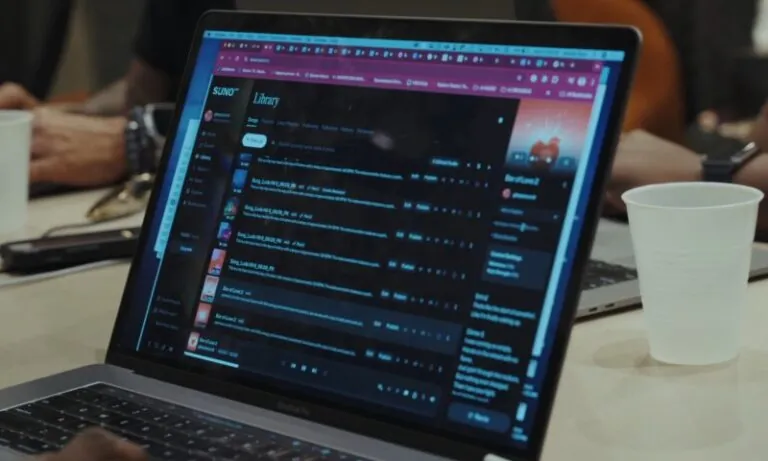

After stepping away from day-to-day Quest operations, Tom Bilyeu launched Impact Theory. The company positions itself as a modern media business centered on long-form interviews, education, and entertainment.

Media businesses create value through several channels.

- Advertising and sponsorships.

- Owned products such as courses and memberships.

- Brand partnerships.

- Licensing and IP development.

- Equity stakes in adjacent ventures.

Most of those streams remain private, so they should be treated as directional drivers rather than precise inputs.

Risk, Regulation, And The Creator Economy

In 2023, the U.S. Securities and Exchange Commission announced an enforcement action involving Impact Theory over an alleged unregistered offering of NFTs called Founder’s Keys.

The SEC described remedies that included the destruction of NFTs in the company’s control and payments totaling over $6 million.

From a wealth perspective, the lesson is straightforward. Creator-led businesses face regulatory and reputational risk when marketing crosses into investment-like territory. Compliance costs and legal exposure can affect revenue and long-term valuation.

How He Built A Multi-Million-Dollar Brand, The Practical Playbook

The most useful part of the story is not a number. It is the pattern.

Build A Product That Survives Scrutiny

Early Quest customers bought a functional promise. Protein-forward convenience with a better-for-you profile.

Coverage also noted later backlash around ingredients and perception, which forced reformulation and message discipline.

- Ingestible and health-adjacent products turn ingredients into marketing and compliance at the same time.

- Community-driven brands experience backlash as quickly as praise.

Treat Distribution As The Product

Quest’s early growth tied directly to who had the product in hand and who talked about it online.

- Seed creators at scale.

- Encourage user-generated recipes and transformations.

- Amplify fan content.

- Build repeat consumption habits.

That approach focuses on systems, not slogans.

Make Marketing Observable

Fitness marketing works when results can be seen. For other categories, the equivalent includes before-and-after demonstrations, transparent comparisons, third-party testing, and credible expert validation.

Visibility creates trust faster than copywriting.

Use Milestones To Tell A Coherent Story

Quest’s public narrative stayed easy to repeat.

Founded in 2010. Explosive growth. Major list rankings. Retail expansion. Acquisition.

A clear timeline compresses credibility and makes media coverage easier.

Use Capital With Intent

Bootstrapping followed by a minority investment at a high valuation works when product-market fit already exists.

- Capital used to find fit finances uncertainty.

- Capital used to scale a proven system finances growth.

Timeline Of Key Public Milestones

| Year | Milestone | What It Signals |

| 2010 | Quest Nutrition founded after prior software experience | Foundational business skill |

| 2014 | No. 2 on Inc. 5000, ~57,000% three-year growth reported | Hypergrowth with metrics |

| 2015 | Minority investment valuing Quest around $900 million | Valuation signal |

| 2019 | Acquisition completed at $1.0 billion | Liquidity event |

| 2021 | Impact Theory NFTs raise roughly $30 million | New monetization model |

| 2023 | SEC enforcement action, over $6 million in remedies | Regulatory risk |

How To Read Net Worth Searches As A Builder

If the goal is learning how wealth is created, the operational levers matter more than headline figures.

- Build a product with a clear functional promise.

- Create distribution through people who already have trust.

- Systemize user-generated content.

- Expand into mass retail after demand pulls you there.

- Preserve founder equity early.

- Treat compliance and reputation as balance-sheet items.

Tom Bilyeu’s financial story reflects disciplined execution across those levers. The exact number attached to his name will always be an estimate. The blueprint behind it is visible, repeatable, and far more valuable than a scoreboard.

Related Posts:

- How I Built This With Guy Raz Review: Best Episodes,…

- 8 Most Popular Topics And Genres For A New Podcast In 2026

- Top Strategies for Building an Authentic Personal…

- Dax Shepard’s 2025 Net Worth - Everything You Need to Know

- Mel Robbins 2025 Net Worth - Motivation Pays Big

- Breakdown of Joe Rogan’s Net Worth and Earnings in 2025