Managing money is about making decisions that shape your day-to-day life. Maybe you’re trying to get out of credit card debt, save for a down payment, or just stop arguing about bills with your partner.

In 2025, you’re not alone, and you don’t have to figure it out from scratch. Podcasts have become a go-to tool for people looking to sharpen their financial habits while staying grounded in real life.

It doesn’t matter if you’re folding laundry, stuck in traffic, or walking the dog; there’s likely a podcast that can slip into that time slot and leave you smarter by the end of it.

Here’s a guide to some of the most practical, engaging, and actually helpful money and lifestyle podcasts out there—ones that dish out real-world financial tips you can start using right away.

1. The Dave Ramsey Show

- Hosts: Dave Ramsey, George Kamel, Jade Warshaw, and team

- Typical Length: 90 minutes

- Release Schedule: Tuesday, Wednesday, Thursday, Saturday

Few shows have the kind of legacy that Dave Ramsey’s does. It’s direct, high-energy, and filled with real people calling in to tackle their financial situations live.

Dave’s style isn’t soft, but it’s effective—and when you’re drowning in debt or unsure how to get started, clear steps matter.

Highlights

- Debt Snowball: Pay off the smallest balances first to build momentum.

- Emergency Fund Rule: Save $1,000 fast, then build toward 3-6 months of expenses.

- The 7 Baby Steps: A framework that guides you from debt elimination all the way to wealth-building.

Why it works: It’s not just advice—it’s real people working through tough spots. If you’re looking for structure and motivation, this one delivers.

Best For: Anyone starting their financial cleanup, especially those who need a plan with no fluff.

2. Choose FI

- Hosts: Jonathan Mendonsa and Brad Barrett

- Typical Length: 40–60 minutes

- Release Schedule: Weekly on Mondays

Choose FI has carved out a niche for people who want more than just financial stability, they want freedom.

Whether that means quitting your job by 40 or just having the option to slow down and enjoy life, the podcast is all about building a future that’s driven by choice.

Highlights

- Learn High-Income Skills: Boost your earning potential through in-demand digital skills.

- Live Frugally, Not Miserably: Find smart ways to cut costs—like optimizing grocery bills or finding low-cost adventures.

- Invest the Simple Way: Focus on index funds for long-term, low-effort investing.

Why it works: You hear from people who’ve made it work. They didn’t win the lottery—they just made smart, consistent choices.

Best For: Goal-setters chasing freedom, not just money.

3. Afford Anything

- Host: Paula Pant

- Typical Length: Varies (10–90 minutes)

- Release Schedule: Sporadic

Paula Pant brings a thoughtful, almost philosophical angle to financial decision-making. She’s about living intentionally, and she’s got the receipts to back it up.

Whether she’s breaking down how to house hack or how to build wealth through real estate, her advice tends to stick.

Highlights

- Start a Side Hustle: Use skills you already have to earn on the side.

- Try House Hacking: Live in a multi-unit property while renting out the rest to cover your mortgage.

- Negotiate Like a Pro: Paula offers salary negotiation scripts that can translate to real raises.

Why it works: There’s an emphasis on choice and values—what you want to prioritize financially.

Best For: People who want to design their life and make money decisions that support it.

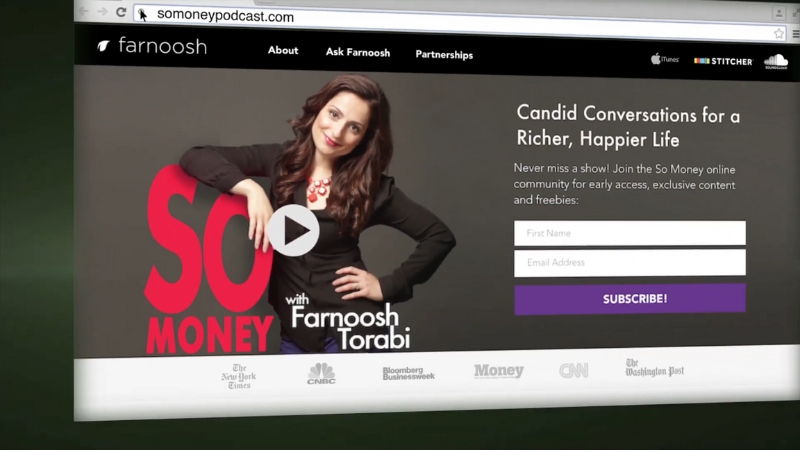

4. So Money

- Host: Farnoosh Torabi

- Typical Length: Around 30 minutes

- Release Schedule: Monday, Wednesday, Friday

Farnoosh brings a sharp yet approachable style to personal finance, blending expert interviews with listener Q&As.

Her Friday episodes are especially useful for those with specific questions, from how to ask for a raise to managing student loans without losing sleep.

Highlights

- Raise Your Pay: Use proven tactics to negotiate higher salaries.

- Manage Student Loans: Learn when refinancing makes sense—or doesn’t.

- Beginner Investing: Clear steps on how to get started without feeling overwhelmed.

Why it works: It doesn’t talk down to you. The topics are relatable, and Farnoosh keeps the pace moving.

Best For: Anyone who appreciates short, sharp episodes packed with applicable tips.

5. BiggerPockets Money

@officialbiggerpockets📍 The worst real estate advice I ever got? Listening to everyone else. I looked at other investors crushing huge deals and thought that had to be my next step too. But I never asked the most important question: “What kind of life do I want?” The truth? You don’t have to follow someone else’s path to be successful in real estate. You just need one that fits you. 🎧 Tune in to learn from my biggest investing lesson — so you don’t make the same mistake!♬ original sound – BiggerPockets

- Hosts: Scott Trench and Mindy Jensen

- Typical Length: 60–90 minutes

- Release Schedule: Tuesday and Friday

This is a great listen if you’ve ever wondered how to start investing but didn’t know where to begin. Yes, there’s a real estate slant—but it covers much more than that.

From taxes to side gigs to long-term wealth planning, it offers tactical advice with a conversational tone.

Highlights

- Earn Passively: Rental properties, online income streams, dividend stocks—all explained with clarity.

- Optimize for Taxes: Learn how tools like Roth IRAs and HSAs can keep more money in your pocket.

- Pay Down Debt Smartly: The “debt avalanche” method helps you save more over time by tackling high-interest balances first.

Why it works: It covers the nuts and bolts of wealth-building without jargon overload.

Best For: Beginners and intermediate listeners ready to take control of their money.

6. For Better & Worth

- Hosts: Chris and Ericka Young

- Typical Length: Around 40 minutes

- Release Schedule: Weekly

Money can bring couples closer—or pull them apart. For Better & Worth doesn’t shy away from that truth. It’s tailored for couples trying to figure out how to get on the same financial page without constant stress or blame.

Highlights

- Hold Money Dates: Carve out time to check in financially as a team.

- Pick the Right Account Setup: Decide what works best—separate, joint, or hybrid.

- Ditch the Shame: Work through guilt and resentment to build healthier financial habits.

Why it works: It’s practical, real, and rooted in personal experience.

Best For: Couples in any stage of a relationship—married, engaged, or just figuring things out. And if you’re that duo thinking about your future, you might also want to explore Everly plans to safeguard your shared goals.

Whether it’s financial planning, legal arrangements, or simply setting long-term intentions, taking action now can build a stronger foundation for what comes next.

7. The Money with Katie Show

- Host: Katie Gatti Tassin

- Typical Length: Around 40 minutes

- Release Schedule: Twice a week

Katie offers a refreshing voice for millennials and Gen Z trying to sort out their money in a world of inflation, gig work, and shifting economic realities. It’s part personal finance, part cultural commentary.

Highlights

- Use Budgeting Apps: Tools like YNAB (You Need a Budget) can change how you think about spending.

- Automate the Basics: Savings, investments, and even bill payments—set them and forget them.

- Stay Inflation-Savvy: Katie explains how to adjust when prices rise faster than your paycheck.

Why it works: It’s current, it’s clever, and it doesn’t feel like homework.

Best For: Listeners who want money advice with a side of context.

Why These Podcasts Are Worth Your Time

Money doesn’t come with an instruction manual, and too many people feel like they’re winging it. These podcasts bridge that gap.

They make things like saving for retirement or budgeting for groceries feel manageable, even when life gets hectic.

And the numbers don’t lie:

- 15% of adults lose $10,000+ a year from poor financial choices—podcasts help cut that down.

- 77% of Americans report anxiety over money, yet many find that regular podcast listening builds their confidence.

- 144 million Americans are podcast listeners in 2025, with financial shows among the fastest-growing genres.

Getting Started

New to money podcasts? Here’s a simple way to ease in without feeling overwhelmed:

1. Know What You Want

Are you trying to pay off debt? Save more? Learn how to invest? Pick a podcast that aligns with your immediate goals.

2. Build a Listening Habit

Plug in while doing the dishes, walking the dog, or driving to work. Even 20 minutes here and there adds up.

3. Use Episode Descriptions

Most podcasts break down what’s in each episode. Skim those to find the ones that hit your current struggles or interests.

4. Take Notes

Jot down one hack per episode you want to try, like automating your savings or starting a side gig. Small wins can build major momentum.

Bonus Picks to Keep in Rotation

Already breezed through the main list? Here are a few more worth checking out:

Podcast

Why It’s Useful

Money for the Rest of Us

Clear investing insights for beginners.

The Clark Howard Podcast

Consumer tips, savings tricks, and financial news.

Marriage, Kids, and Money

Family finance strategies, college savings, and generational wealth advice.

Final Thoughts

There’s no one-size-fits-all when it comes to money, but that’s the beauty of podcasts. Whether you’re in your 20s trying to figure out credit, in your 40s planning for retirement, or somewhere in between, there’s something here for you.

Some even focus on real ways to make money on the side, offering practical ideas you can act on right away.

The right advice, at the right time, can change the way you live. And with so much of it available for free, there’s never been a better time to start listening, learning, and building the life you actually want.

So go ahead and pick one, hit play, and let smart money habits follow. One episode at a time.

Related Posts:

- Top 14 Podcasts for Moms - Parenting, Lifestyle, and More

- Top 8 Podcasts to Help You Make Money on the Side in 2025

- Private Life of Beyoncé: Homes, Retreats, and Travel…

- Retired NBA Star Charlie Ward Shares His Stroke…

- Dan Bilzerian Net Worth, Best Podcast Moments, and…

- Top Premier League Podcasts You Can't Miss - Expert…